3D Systems Corporation (NYSE:DDD) reported mixed results for first-quarter 2018, wherein the top line beat the Zacks Consensus Estimate, but earnings missed the Consensus mark. Moreover, though revenues marked year-over-year improvement, the bottom line registered a decline.

The company posted non-GAAP loss of 3 cents as against earnings of 6 cents reported in the year-ago quarter. The Zacks Consensus Estimate was pegged at earnings of a penny. 3D Systems noted that unfavorable sales mix, along with increased investment in services and on-demand manufacturing, and elevated operating expenses, more than offset the benefit of higher revenues.

On a GAAP basis, the company’s loss widened to 19 cents per share from 9 cents posted in the first quarter of 2017.

Inside the Headlines

This 3D printer maker reported revenues of $165.9 million in the quarter, reflecting a year-over-year increase of 6%. Steady demand for the company’s healthcare, software and on-demand manufacturing, along with increased printer unit sales proved conducive for the top line. Moreover, revenues beat the Zacks Consensus Estimate of $159 million.

3D Systems’ Healthcare revenues were up 21% to $52.4 million year over year, driven by growth across all categories. Notably, the company’s on-demand manufacturing revenues were up 2% to $25.7 million, helped by its investments in facilities, customer experience and technology.

Software revenues were up 13% to $23 million. Material revenues remain approximately flat at $42.5 million. Printer revenues increased 24% and came in at $39.1 million. Meanwhile, printer unit sales surged 44%, resulting from increase in both production and professional unit sales.

In the reported quarter, non-GAAP gross margin contracted 420 basis points on a year-over-year basis to 48.2%. The decline was mainly due to unfavorable sales mix and increased investment in services, and on-demand manufacturing, which more than offset the cost-reduction benefits achieved from ongoing supply-chain initiatives.

In the reported quarter, the company’s non-GAAP operating expenses flared up 10% to $79.5 million, as SG&A (up 8%) expenses rose significantly, driven by the company’s persistent investment in go-to-market and IT transformation. Non-GAAP R&D expense also escalated 13% in the quarter.

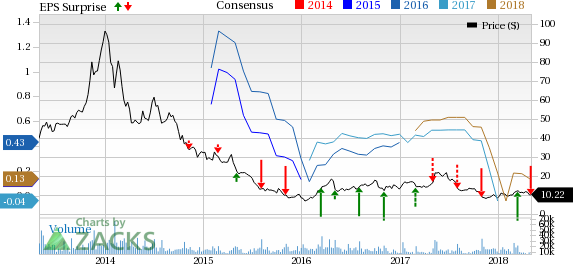

3D Systems Corporation Price, Consensus and EPS Surprise

Cash Flow and Balance Sheet

3D Systems ended the first quarter with cash and cash equivalents of $126.1 million, down from $136.3 million as of Dec 31, 2017. During the quarter, the company used $1.5 million of cash toward operational activities.

Bottom Line

3D Systems has a volatile earnings history, oscillating between incredible beats and abysmal misses in the trailing four quarters. Unfavorable macroeconomic factors, such as slowdown, inflation, currency fluctuations and commodity prices impacted the company’s performance. This apart, escalating R&D, IT and go-to-market expenses might prove to be a headwind.

Nevertheless, the company has been benefiting from favorable 3D printing industry fundamentals, led by rising demand for diverse application of this novel technology across several domains. Going forward, strong demand for production printers, materials and software, as well as healthcare solutions will likely act as major catalysts for growth. We also believe the acquisition of Vertex-Global Holding B.V will unlock multiple opportunities for the company.

Currently, 3D Systems carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are CoStar Group, Inc. (NASDAQ:CSGP) , Dell Technologies Inc. (NYSE:DVMT) and Science Applications International Corporation (NYSE:SAIC) , all sporting a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term expected earnings growth rates for CoStar Group, Dell Technologies and Science Applications International are 16.8%, 9.1% and 5%.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

3D Systems Corporation (DDD): Free Stock Analysis Report

CoStar Group, Inc. (CSGP): Free Stock Analysis Report

SCIENCE APPLICATIONS INTERNATIONAL CORPORATION (SAIC): Free Stock Analysis Report

Dell Technologies Inc. (DVMT): Free Stock Analysis Report

Original post

Zacks Investment Research